European Selection Fund - Sep 2020

- AJ

- Oct 30, 2020

- 2 min read

Updated: Nov 24, 2020

Factsheet: September 2020

Indices in Europe have recorded a slight fall, with the Euro Stoxx 500 down by 2.56% and the CAC 40 by 2.73%.

Despite positive economic indicators, which showed a clear recovery in the third quarter, markets were affected by the correction in the technological sector in the US Markets (where the Nasdaq100 dropped by 7%) and by the uncertainties surrounding the US presidential election.

At the same time, the significant outbreak of Covid contamination on the Old Continent further raised concerns about new restrictions and social distancing measures that would be detrimental to the economy.

Sector-wise, Retail and Consumer Discretionary are up by 3%, while Financials and Energy are down by 11% and 10% respectively.

About our Fund

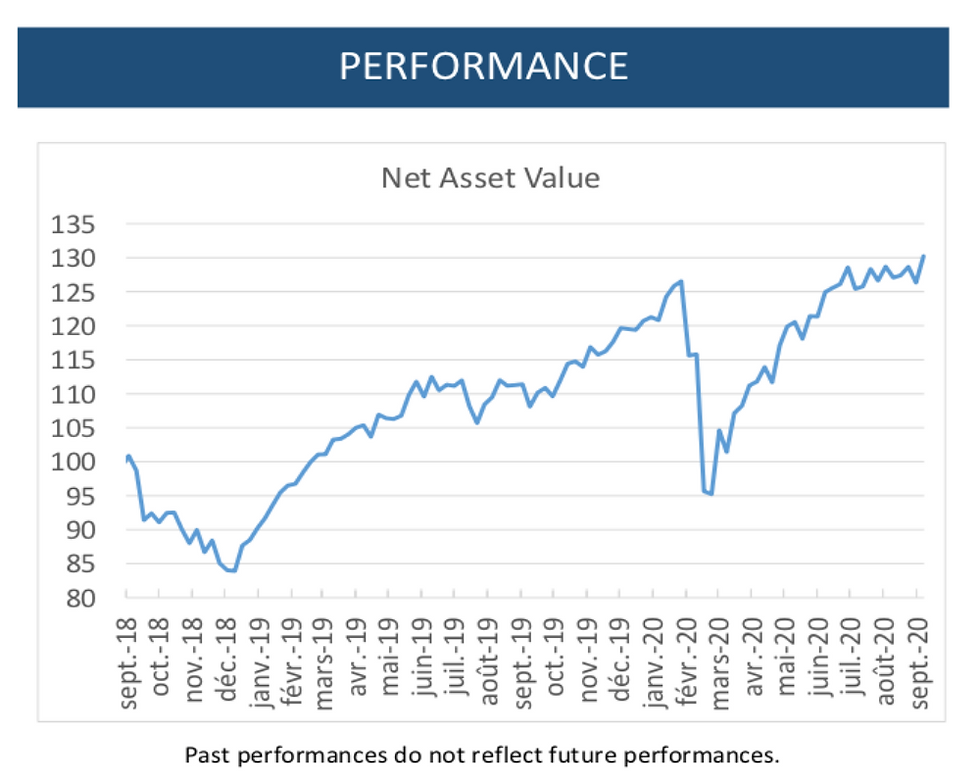

Over the month, the fund grew by +2.48% and clearly outperformed the indices, which are in negative territory.

We benefitted from the excellent performance of Sonova (+10%) for which sales of hearing aids had been significantly delayed during the lockdown period, and whose orders are on the up again. Sika (building materials) and Givaudan (flavour manufacturer) also performed well with increases of 6%.

On the other hand, Temenos was down by 16%. The banking software provider is hit by the poor financial health banks which are being forced to reduce their expenditure.

We remain optimistic regarding the long- term prospects for Temenos, as banks cannot manage without this type of software, as it is a legal and regulatory obligation.

Forecast

Europe is at the same time monitoring the evolution on the US presidential elections and the outbreak of contamination. The potential election of the Democratic Party could be considerably limited by a Republican majority in the Senate, while the resurgence of the Covid pandemic could lead to the end of the de-confinement and the reintroduction of social distancing measures which would once again affect the economy.

Within this context filled with uncertainties, we are maintaining our investment strategy and stock picking approach, which has once again proved to be effective in weathering financial stress and performing better in rising markets.

Market leadership, high margins, reinvestment capacity and low leverage of the companies in our portfolio seem to us to be, more than ever before, the key factors causing the long-term outperformance that we are achieving.

For more information, please email us: contact@sinewsportal.com

Comments